ESSENTIAL LAW BLOG

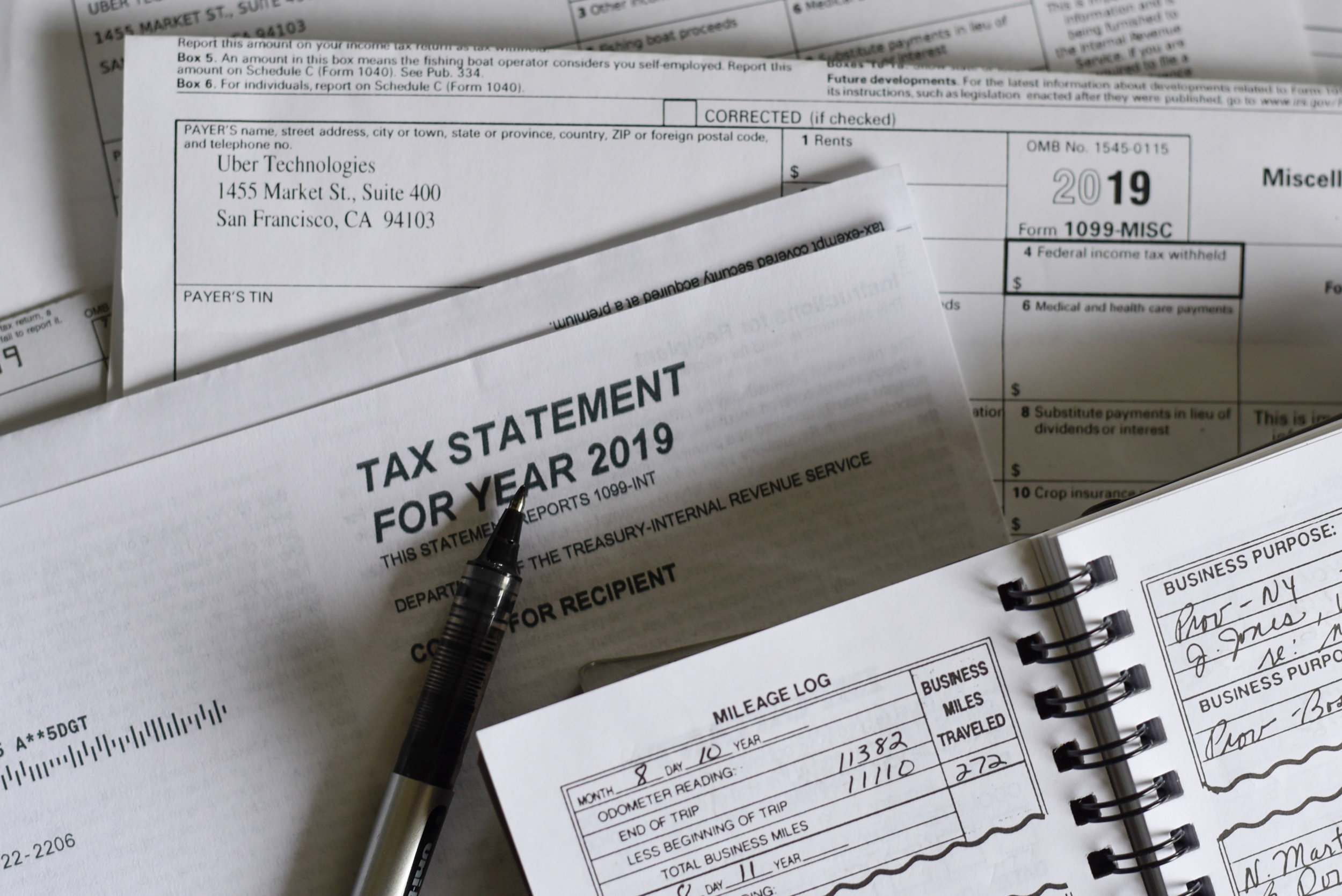

Both Opportunity Zone funds and 1031 exchanges are ways of reinvesting gains from the sale of a property into another property in order to avoid current taxation and obtain valuable tax benefits. These regimes were created by Congress and codified in the Internal Revenue Code. Both are important tools for managing tax liabilities and for acquiring tax-advantaged investments. One is driven by a national agenda to promote investments in certain locations; the other is driven solely by the taxpayer’s agenda. One regime is very old; the other is very new. Which is the right one for you?

There are other transaction details you may easily overlook, such as the myriad of additional fees and costs charged to buyers as part of their home purchase transaction, also known as closing costs. These costs can add up quickly, so keep reading to find out more about closing costs, what to expect, and how much you may need to pay.

Landlords almost always ask for a security deposit when leasing property to a tenant. This is a sum of money that is held to cover any damage that may occur throughout the course of a tenancy. Although the landlord holds it, a security deposit remains the property of the tenant. The security deposit may be used only for damages that make the apartment un-rentable.

On July 22, 2020, Illinois Governor Pritzker announced an extension of his previous eviction moratorium until August 22. The extension both prohibits a landlord from commencing a residential eviction action and prevents the Sheriffs from enforcing an eviction order until the 22nd of August.

Home and commercial space transactions can be complex, and the timeline is subject to individual circumstances. Below are the general steps and how you can best set yourself up for a smooth transaction:

Home and commercial space transactions can be complex, and the timeline is subject to individual circumstances. Below are the general steps and how you can best set yourself up for a smooth transaction:

If you’re a business owner looking to limit your personal liability, forming a Limited Liability Company or a Corporation should be a top priority. There are many options to consider when structuring your company, so it is important to carefully evaluate your short term and long terms goals.

A general partnership is a business entity in which two or more “general” partners hold an equal share in the profits, losses, and ownership of their business. A limited partnership is a business arrangement with at least one general partner and one limited partner.

Governor Pritzker’s COVID-19 response plan is once again under fire. This time it is landlords suing him over the eviction moratorium issued in Executive Order 2020-30. The moratorium prevents landlords from filing evictions for nonpayment of rent. This means that even if someone is able to pay their rent and choose not to, a lawsuit cannot be brought against them until the expiration of the Order.

New laws, orders, and regulations have been issued that amend the terms of the landlord-tenant relationship. This includes a broad reaching eviction moratorium instituted by Governor Pritzker. There are now new rights and responsibilities for landlords and tenants. In addition, the court closures have exacerbated many problems that have arisen during the public health crisis. Read about the federal, state, and city response and how eviction proceedings have been modified.

A sealing order is a judicial order that removes a court file from the public record. This means that when a member of the general public searches for that specific court case through public channels, it will not appear. Unlike an expungement from a criminal record, a sealing order does not eliminate a court file from an individual's record. It simply makes that particular court file inaccessible to the public.

There are different ways an entrepreneur can own and operate a business. Below are general descriptions of the most common options. Depending on goals such as fundraising or desired ownership, one of the following options may be best for you.

One of the biggest mistakes that entrepreneurs can make when they are first getting started is not protecting their intellectual property right from the beginning. There are many valid reasons for this: it’s not legally required, it can drive up initial costs, doing it correctly can be very complicated, and entrepreneur’s often do not foresee these issues. When we help startups build successful brands and companies, we make sure all of their intellectual property needs are met right away. Here are 5 tips that will ensure that you are setting your company up for long-term success.

In the City of Chicago, property taxes are paid in arrears. This means that property tax amounts are due the year after the tax year has passed. When a Buyer and Seller are working on their property sale, the property tax proration is a negotiated term. Because taxes are paid in arrears, the parties will not yet have received the property tax bill for the current year by the time of the closing. With each subsequent year, taxes go up. For this reason, the seller will usually pay 105+% of the previous year’s tax bill.

When purchasing property, there are a few ways that a new owner can “take” title. There are three ways that the State of Illinois allows multiple property owners such as family members or business partners to hold title. 1) tenants in common, 2) joint tenants with right of survivorship, or 3) tenants by the entirety. Typically, new owners can choose which way to hold title and this can be changed in the future. It is important for Buyers to understand the different ways title can be held as it may affect the rights of creditors or the transfer of the property after an owner’s death.

In addition, there are different types of deeds that can be used to transfer title. There are four main types: General Warranty Deed, Special Warranty Deed, Bargain and Sale Deed, and a Quitclaim Deed. We will cover these types of deeds below after the types of title.